An Optimistic Start to 2023 Meets a Goldilocks Market

In this quarter’s newsletter, we look at increased optimism among industry leaders, the much-needed adoption of advanced technology to support the current landscape, and the rise of regional operators. Operators will find more opportunities to put lessons learned since the onset of the Public Health Emergency (PHE) into action this year.

Table of Contents

Optimism Rises Across the Industry

While alarm bells still ring around inflationary fears and a deepening recession in 2023, the outlook among skilled nursing professionals appears to be more optimistic as we kick off the new year. A recent McKnight’s Outlook Survey showed almost a third of leaders in the industry are more optimistic about the year ahead, up from ~20% heading into 2022. The proven resiliency of those who have weathered the last three years has undoubtedly given decision-makers a boost in confidence after living through a tidal wave of new regulations, a concerted effort to muddy skilled nursing’s reputation, and a prolonged staffing crisis.

Operators who previously feared failure and emerged with relatively stable facilities can look at 2023 as a year with manageable, familiar factors impacting their businesses. For the most part, staffing remains the prime issue, followed by rebuilding census, staffing mandates, and staff vaccinations reports McKnight’s. In general, these are nothing new to the industry, and savvy administrators and owners have learned how to keep their facilities running with dedicated staff stepping up to provide quality care, even with endemic issues.

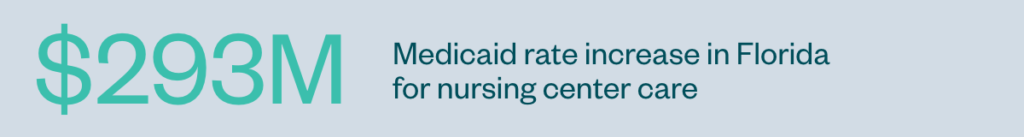

Overall, the outlook for 2023 is hopeful. At this moment, there are no serious concerns about COVID variants becoming more lethal, and a united effort to communicate the importance of matching CMS funding to staffing mandates is echoing throughout the Hill. States, meanwhile, are tackling that issue head-on, with Illinois and Florida, for example, earmarking funding for higher wage rates for much-needed workers.

No one can predict with certainty the severity of an economic downturn, but operators should remain confident in the industry’s persistent recovery.

Technology is Already Easing Staffing Pressures

Topping the list of vital solutions this year is the adoption of technology to advance facility operations and ease the burden of slim staffing across the industry. Any operator that isn’t looking to bring in as much automation as possible to back office and daily facility operations is throwing away time and money on mundane tasks that can easily be replaced by the right software or solution.

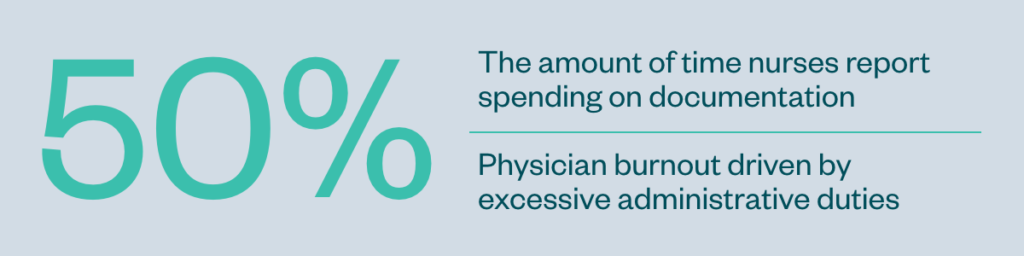

In other industries, business leaders have been adopting technology as they become available to make workplaces more fulfilling for their staff—from managers to entry-level workers. In healthcare, in particular, a significant body of literature outlines clinician dissatisfaction with burdensome paperwork duties that take them away from their patients.

The answer for many administrators and operators is a combined effort to implement the right technology that is vetted by those who will be using it. There are few things more disappointing than the promise of simplicity but the reality of overly complicated software that chokes up workflows or keeps nursing home staff from completing their core duty—delivering quality care.

Sources:

Reduce Administrative Task Burdens to Help Fight Nurse Burnout

Administrative Burden and Burnout

In long-term care (LTC), consistently tight funding makes it difficult for those in operations to argue for the latest technology, but outsourcing presents a viable way to incorporate sophisticated tools into your facilities’ back office. At LTC Ally, we recently sat down with COO Mark Josefovic and CTO Stephen Nusbaum to discuss in detail the technology they built to tackle the operational complexities of skilled nursing that help operators—and their residents—thrive.

Read the exclusive interview here

Regional Operations Increase Their Footprint

The arena is set to mark a tremendous growth in regional operators taking over facilities from national business models. Most notable is the ProMedica-Welltower joint venture being slowly handed off to Integra’s management, whose business plan entails sub-leasing facilities to 15 regional operators with a track record of strong performance. Welltower will continue to hold a majority stake in an 85/15 joint venture, with Integra guaranteeing leases and net worth requirements. In total, the portfolio includes 147 skilled nursing properties across the country, with changes of ownership expected to be completed by Q1 of 2024.

Other behemoth operators are following suit. In a statement to the press, SavaSeniorCare said they “made the decision to transition the portfolio of nursing centers to regional operators” as it winds down operations entirely. Brickyard Healthcare, previously Golden LivingCenters, has also downsized from a multi-state operator to now solely managing 23 facilities in its home state of Indiana.

On the other side of the scale, the number of single-site nursing homes is expected to dwindle in coming years, with the majority of buyers in today’s marketplace being multi-facility owners with strong investor backing.

While each model has its benefits, larger operations tend to have more robust backing, enabling them to make long-term investments in technology, infrastructure, and staff that can maximize efficiencies and make the most of slim reimbursement rates. Single site owners—while better positioned, in some cases, as trusted long-term partners within a community—can lack the monetary agility required to meet industry advancements that make other nursing homes more attractive to hospitals referring residents with complex care needs.

It appears market pressures have created an environment where no operation too large or too small will be able to weather the changing skilled nursing landscape. Instead, a Goldilocks scenario is playing out across the nation. Regional operators with strong local performance are looking to conquer their territory while the playbook of centrally governing a national portfolio from afar is becoming something of the past.

Proven Partners in Long-Term Care

LTC Ally provides leading back office and growth advisory services for long-term care operators across the United States. Since 2006, we have helped operators thrive by optimizing their revenue cycle, securing profitable contracts, and providing expert financial services backed by proprietary technology built to meet the exact needs of the long-term care industry.

See how we helped one operator gain 2,000 skilled nursing days after getting in-network with a highly sought-after contract.